Africa’s second largest copper producer after the Democratic Republic of Congo – DRC, Zambia, is at a very critical stage of its economic trajectory. The red metal producer has in the last few weeks made strides to restore fiscal fitness after contracting Lazard Freres a French investment banking firm to reorganize it external debt. Earlier in the week begining 22 June, Zambia’s authorities approved commencement of an economic program discussions by the Daneshwar Ghura led International Monetary Fund – IMF Article IV mission team who are in talks with Zambia on an information exchange program. Talks will run to the 02 July virtually. Zambias’s fiscal posture is dented by elevated debt of $11.23bln, domestic arrears of K26.2bln in unpaid bills to contractors, retirees and suppliers. Disease pandemic posed by COVID19 has forced a systematic reallocation of fiscal funds to public health at the expense of real sectors of the economy causing a shriveling in growth significantly. Zambia’s economy is expected to recede to -0.8% in 2020 according to the World Bank recent report published in June.

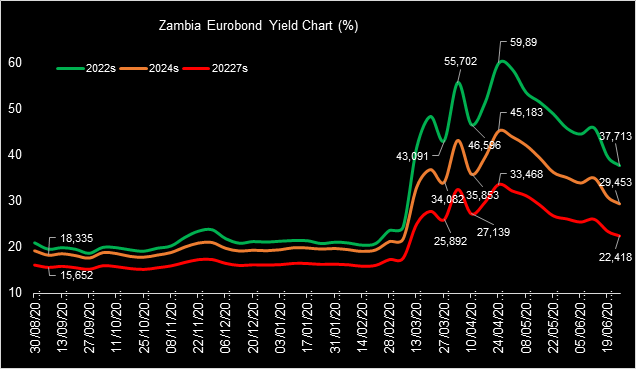

Zambia closed 2019 with its bonds maturing 2022, 2024 and 2027 paying 21.355%, 19.521% and 16.234% respectively as its grappled with energy poverty as climate change effects weighed on the copper producer whose dam levels at the Kariba fell significantly impacting hydro power generation. Fiscal vulnerabilities were already priced into the countries dollar bonds as default risk reflected in the foreign currency denominated assets.

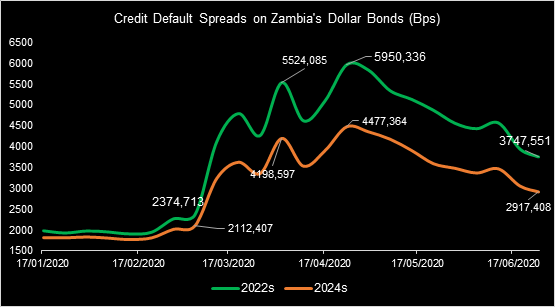

Disease Pandemic. COVID19 pandemic in 1H20 amplified Zambia’s fiscal posture causing budget distortion exacerbated by the need for higher public health spend which has widen the 1H20 budget deficit by a significant quantum to surpass the 6.5% 2020 targeted rate. on account of unplanned spend. the fiscal strain priced into credit spreads on Zambia’s dollar bonds causing a widening between 4,477 – 5,950 basis points (April highs) for paper maturing in 2022 and 2024.

Global Uncertainty. Risk appetite globally has been on a seesaw given the pulse posed by rising COVID infection cases in different jurisdictions which dented aggregated demand, caused supply chain disruptions resulting in commodity price shocks that widened debt to GDP ratio’s. Stock and currency futures dislocation from global growth is the widest in the history of the world. As emerging and frontier market currencies weakened, asset prices shriveled forcing market participants to preferred their liquidity housed in safe haven assets such as dollars, US treasuries as opposed to riskier assets whose demand then plummeted. Dollar index against a basket of 6 major currencies was at its peak in April at 102.5 but has since eased to 97.3 levels as the world is more optimistic about economies re-opening. The cocktail of information flow precipitated by rising cases caused volatility in the financial markets that then priced into dollar denominated assets including emerging and frontier market eurobonds to include Zambia.

The African Debt Quagmire. As the emerging and frontier market currency rout persisted, more offshore investors exited local currency denominated assets with preference dollars as safe haven which weakened exchange rates and as such ballooned debt to GDP ratios causing debt repayment bubbles. Falling commodity prices increased fiscal balancing pressure and it is for that reason African finance ministers through the Africa Union echoed debt moratoriums and potential cancellations to ease the burden or else face default risk and sharp recessions. Some countries such as Nigeria, Kenya and Ghana did receive COVID emergency assistance from the IMF while Zambia on account of debt un-sustainability has not been granted assistance which has made holders of its bonds very weary, jittery and nervous about its repayment capacity and as such has fueled asset sell off pressure in addition to unattractiveness of its government securities. The blow out in credit default spreads on Zambia’s 2022, 2024 and 2027s was felled by a cocktail of factors key of which gravitate around fiscal posture concerns, rising sovereign risks amplified by disease pandemic.

Post April, credit default spreads on Zambia’s dollar bonds have narrowed by 1,888bps (1.9%) on average supported by an array of developments ranging from a more positive sentiment on Zambia’s fiscals as the IMF has been mandated to conduct bailout talks with Zambia (after the copper producer took steps to restructure its debt following appointment of Lazard Freres) to a lesser severe recession forecast to -0.8% (World Bank estimate) from -2.6% (IMF estimate at the April virtual spring meetings). Other sentiment drivers include rising copper prices which have recovered from March lows of $4,343/MT to current levels shy of $6,000/MT as demand for base metals increases. The rally has nonetheless been capped by resurgence of coronavirus infection cases in Latin America and China.

The Kwacha Arbitrageur