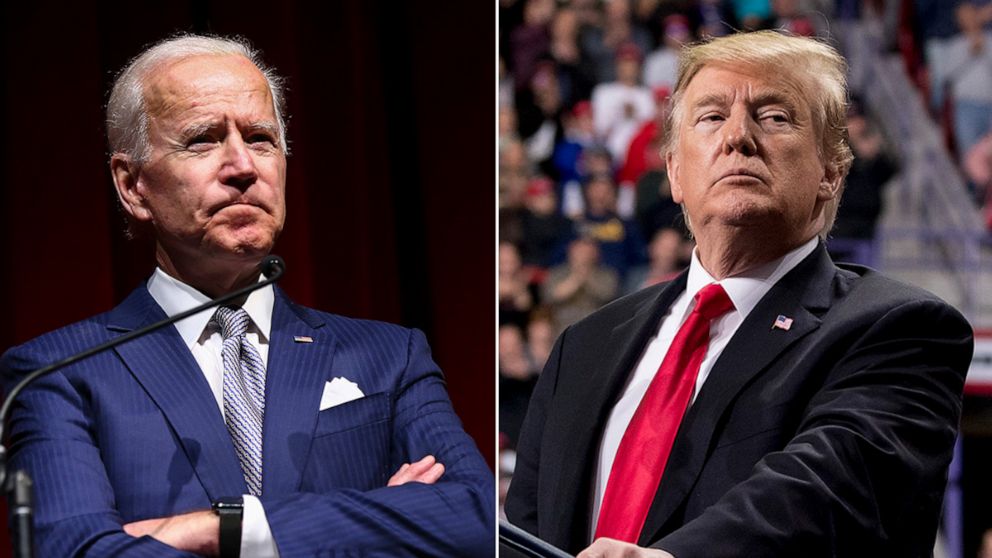

November 6 marked a historic turn as Donald J. Trump secured re-election as U.S. President, once again assuming leadership of the world’s largest economy. Triumphant over Vice President Kamala Harris of the Democratic Party, Trump now becomes both the 45th and 47th U.S. head of state in a globally anticipated election. This outcome has profound implications for trade policy, geopolitical alignment, macroeconomic direction, climate initiatives, and emerging market (EM) support. In this episode, we delve into the ramifications for EMs, especially amid an economy strained by conflict and climate risks.

Historical Context: In the prior election, Trump lost to Joe Biden amidst heavy scrutiny of his pandemic response, despite achieving record-low unemployment. COVID erased these economic gains, yet Trump’s return has stirred debate around his prospective policies, especially on trade, climate, and his enduring “Make America Great” agenda. Here’s what his renewed leadership may bring:

Climate Policy – While previously skeptical of climate change, Trump may adapt to the decarbonization trend driven by global demand for green metals critical to EV and renewable energy. With Tesla’s Elon Musk—a vocal Trump supporter—on board, U.S. policy could benefit from Musk’s insights into sustainable energy and green technology. We see this as a bullish driver for base metals, aligning with U.S. infrastructure plans that may provide further momentum to metals like copper. The current U.S. climate policy under the Biden administration emphasizes a commitment to both domestic and global climate resilience and aims to achieve net-zero emissions by 2050. This policy approach combines regulatory actions, strategic investments, and support for carbon markets to mitigate climate impacts and foster a more sustainable energy landscape. It is likely that Trump could view climate change differently this time around. However the extent of participation is what remains vague.

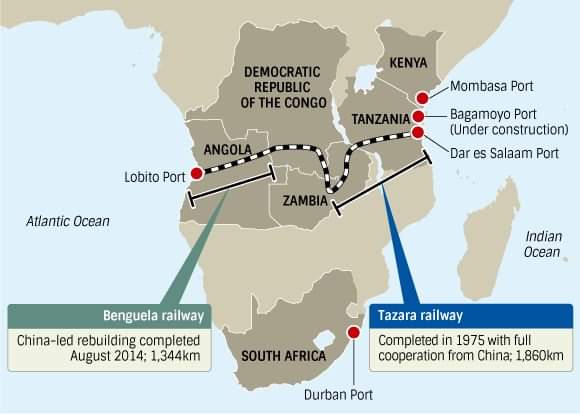

Investment in African Resources – Contrary to concerns over reduced U.S. engagement, competition over green metals has Africa poised as a key resource hub. China, Russia, and the UAE’s investments in African infrastructure—like the DRC-Zambia rail link to Angola’s Lobito port and China’s pledge to revitalize the TAZARA line—underscore Africa’s strategic value. Trump’s focus may pivot to these corridors, given U.S. interests in raw materials and investment in African infrastructure.

Potential Rise in Commodity Demand – As many African and EM’s economies are dutch diseased (rely on single commodities for exports), Trump’s focus on infrastructure revitalisation, manufacturing, and home building could create increased competition for commodities beyond just green energy. His agenda to build factories and housing, avoiding Chinese supply chains, may drive demand for metals and building materials.

Prosper Africa 2.0 – Trump is expected to revive his 2018 Prosper Africa initiative, aiming to shift U.S.-Africa economic relations from aid to trade to compete with China. This strategy may emphasize deal-making over funding, expanding trade relations and diversifying U.S.-Africa trade. Agencies like USAID, EXIM Bank, and the African Development Foundation may focus on trade facilitation instead of social initiative financing. This aligns with Trump’s immigration policy, promoting economic investment to curb migration. Additionally, Trump’s approach aims to lessen Africa’s alignment with China and Russia at the UN, addressing a key geopolitical challenge for the U.S.

Import Tariffs – Trump’s reiterated 20% import tax underscores a protectionist stance potentially detrimental to inflation control, a priority for the Fed. Analysts forecast continued trade tensions, especially with China, given its own economic vulnerabilities. While room for negotiation remains, particularly around intellectual property and rare earths, the imposition of tariffs could provoke economic headwinds globally.

Geopolitical Dynamics – Trump’s relations with Russia and his claims of quick conflict resolution have raised questions about U.S. support for Ukraine, which previously received substantial aid. Putin’s congratulations hint at a collaborative tone, though key uncertainties remain around U.S. funding for Ukraine’s Zelensky and U.S. posture in the Middle East, especially toward Iran. These stances are crucial for commodities markets like crude oil and natural gas, given regional volatility.

Currency and Emerging Markets – Markets reacted strongly to Trump’s perceived pro-business stance, with the U.S. Dollar Index (DXY) climbing to a four-month high as investors anticipated potential dollar-supportive policies. While the immediate spike reflects positive investor sentiment, sustained dollar gains under Trump’s term are uncertain. Historically, market sentiment often shifts significantly after elections, but it’s likely to stabilize as traders gain more clarity on policy directions.

Following Trump’s 2024 win, the DXY recorded substantial gains, driven by expectations for policies like tariffs and economic nationalism that could favor dollar strength. Pre-election trends saw the index rally to above 104.30—its highest level in three months—as traders anticipated that similar policies from Trump’s past administration might lead to inflationary pressures and possibly higher interest rates, which tend to further support the dollar.

IMF Policy Impacts – U.S. election outcomes typically exert minimal influence on IMF policy. The IMF is expected to continue focusing on financial and fiscal stability across EMs, largely unaffected by U.S. political shifts. However we do not rule out scrutiny by markets and emerging economies, given Trump’s history of critical stances toward multilateral institutions. During his first term, Trump’s administration often questioned the benefits of international bodies like the IMF and sought to reduce the U.S.’s financial contributions, prioritizing a more inward-focused, “America First” approach. In 2024, Trump’s return raises questions about whether his administration will support or challenge IMF policies, particularly regarding emerging markets that heavily rely on IMF aid programs. But could this be a different Trump that’s more empathetic post COVID that ravaged many underprivileged nations?

Under a more conservative U.S. administration, EM’s may feel more comfortable dealing with Western institutions, as certain social issues which are considered sensitive in many African societies, may become less central in negotiations.

Global Monetary Policy – Fed Chairman Jerome Powell reaffirmed the Fed’s independence, maintaining that monetary policy will not adjust due to political shifts. This week, the FOMC cut rates by 0.25% to a range of 4.5%-4.75%, as the Fed pursues moderate stimulus to support employment. Powell’s firm stance offers assurance that rate policies will remain consistent with economic needs rather than political influences. Trump also seeks to maintain low interest rates to support his affordable housing and growth-driven initiatives. He seeks to build millions houses during his term of office to plug the accommodation deficit.

The Kwacha Arbitrageur