In the labyrinth of recessionary pressure induced petroleum price plummets, power woes and a strong global decarbonization drive, energy businesses will seek diversification opportunities so as to remain afloat. One such entity that has taken a bold stance to widen its earning streams is Lusaka Securities Exchange listed PUMA Energy (ISIN:0000000185) that intends to venture into the liquefied petroleum gas sector. PUMA seeks to acquire Ogaz Zambia, the second largest LPG gas provider commanding a 17.4% market share after Afrox at 25%. PUMAs appetite for the transaction is supported by a favorable environment for clean cooking promotion by both global and international actors coupled with its appetite for diversification to the retail client space.

“The Board of Directors of Puma Energy Zambia Plc (“PUMA” or the “Company”) wishes to inform shareholders (“Shareholders”), and the market that, PUMA has entered into a transaction with Ogaz Zambia Limited (“Ogaz”) whereby the Company will acquire Ogaz’s Liquefied Petroleum Gas (“LPG”) related assets (the “Transaction”)”.

“As at January 25, the market value of PUMA was K800 million. Accordingly, the percentage ratio of the consideration ($3.4 million or K64.6 million as at exchange rate on the same date) to the market capitalization of PUMA is 8%. In accordance with the categorisation methodology of Section 9 of the listings requirements of the Lusaka Securities Exchange (“LuSE”), the transaction is classified as a category 2 one,” the SENS carried.

Africa’s second largest copper producer Zambia faces power bottlenecks after dam levels at the Kariba, the world’s largest man-made lake, plummeted to alarming levels affecting power generation. The national power utility has rolled out an 8 hour daily schedule that continues to dent business and household activity.

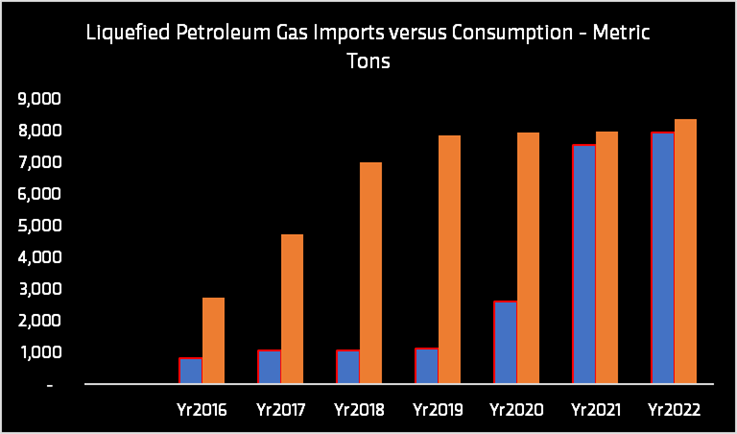

The Energy Regulations Board reveals that LPG usage as a cooking solution for households has steadily risen over the past year. Gas imports have grown 189% to 7,548 metric tons in 2021 a sharp spike as households migrate to cleaner cooking solutions.

Currently trading at $82.66 and $76.53 a barrel softer global demand for petroleum, in a receding world economy, has weighed Brent and NYMEX West Texas Intermediate futures prices. This is a strategic risk factor for energy firms in margin squeeze which diversification will seek to hedge against.

Ogaz Zambia is a wholly owned Zambian company that distributes and supplies a plethora of industrial gases and related services – mainly LPG in addition to carbon dioxide, oxygen, nitrogen and acetylene. The company supplies gases for commercial and domestic use.

The Kwacha Arbitrageur