The head of state and Chief Investment Officer in Africa’s red metal hotspot has called for banks and other financial partners to price capital fairly in funding transactions that will actualize the protocols that ‘Africa’s Copperbelt’ (Zambia and Democratic Republic of Congo) signed to support global decarbonization initiatives through production of electric car batteries and clean energy generation. These are initiatives that will reduce carbon emissions significantly. President Hakainde Hichilema said this in his signing ceremony speech on April 29 in the capital Lusaka.

Electric car battery manufacture in Europe.

Speaking during the ceremony Hichilema said, “Signing is just but one step but the English saying goes, the taste of the cake is in the pudding, we want transactions, we want deliverables, not yesterday but maybe last year because we are behind schedule and may need to burn the midnight candle to close the gap. Financial and technical partners, please come on board to be a part of this story but we also want capital that is fairly priced. Africa continues to be the continent with the highest price for capital, we do not want that to continue.”

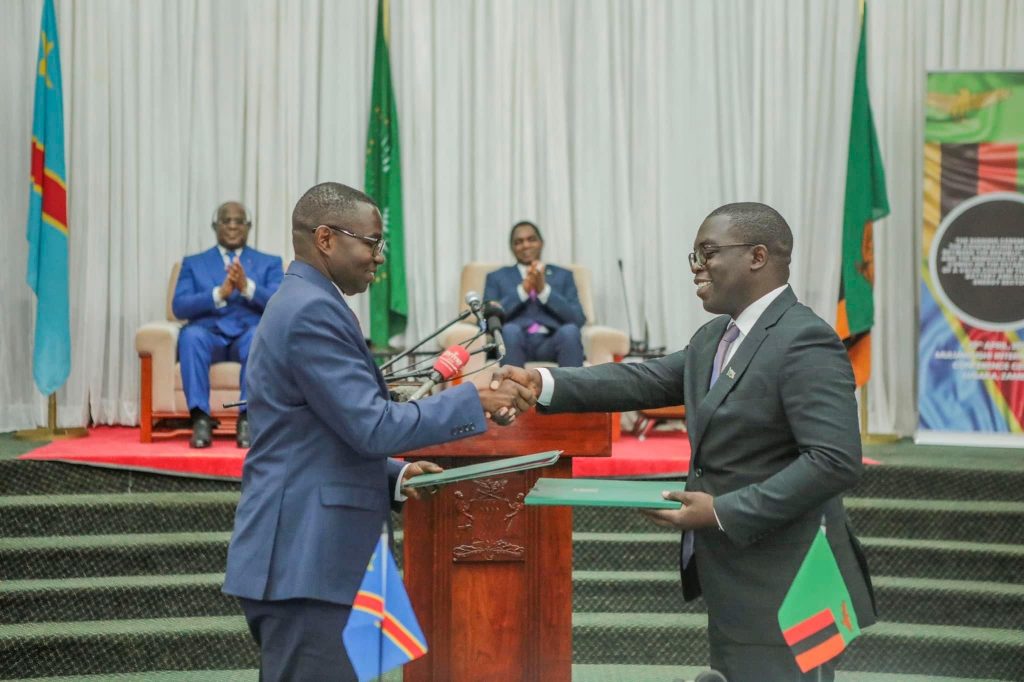

Commerce and Industry Ministers of DRC and Zambia ink an economic protocols.

Zambia and DRC last Friday signed economic protocols, an autopsy of the December 2021 Africa Business Forum held in DRC, that will see the two nations promote value addition through electric car battery production and support clean energy generation leveraging off their rich cobalt and copper deposits. The two nations dubbed the Copperbelt of Africa are said to house over 70% of the globes cobalt and 11% of copper deposits. Hichilema and Tshisekedi, will seek to drive an economic transformational agenda through commercialization of global decarbonization efforts aimed at preserving the planet through championing initiatives that curb carbon emissions into the ecosystem such as the electric car and cleaner energy generation rollouts.

Electric cars will be the biggest drivers of copper demand in the coming decade.

It is vivid that climate change has become an urgent problem for the world for which 10% or $23 trillion is likely to be eroded in gross domestic product if nothing is done by 2050.

Bank of Zambia Denny Kalyalya highlighted the critical role the financial sector will play in actualization of these efforts which covers mobilization of financial resources which will leverage of the strengthened coordination between the regulators and the bank to non-bank financial institutions. “There will be different financing needs such as finance of mature and already existing business to venture capital finance and provision of other services. Strengthened coordination by regulators with bank and non-bank financial sectors will be critical for insurance and capital markets for which coordination between the central bank, Pensions and Insurance Authority (PIA) and the Securities and Exchange Commission (SEC) has already commenced.”

Kalyalya lauded the Zambian authorities for the fiscal discipline strides and debt sustainability that is manifesting in lower yields that will eventually lower the cost of capital. Zambia’s fiscal hurdles have for a long time reflected in the term structure of its interest rate curve which is a key determinant of term funding costs.

While Presidents Hichilema and Tshisekedi have demonstrated leadership that creates the right economic environment for the private sector to thrive and create value, financial partners have been urged to provide ‘fairly priced’ capital to fund transactions that will actualize this landmark cause. It is vivid that the two leaders have a vision however effective operationalization of the protocols will require transactions that require financing, a role commercial and development banks have to play.

Africa Export and Import Bank Head Client Relations for Southern Africa Andrew Masuwa said, “According to Afriexim bank, Zambia and DRC is home to 30% of all global mineral resources and the extractive industry which if well harnessed will contribute $30 billion of revenues over the next 20 years to the continents government coffers. As Afriexim we reaffirm our commitment and willingness to advance DRC and Zambia’s battery precursor by playing lead developer role by employing a full suite of financial instruments at our disposal.”

The Kwacha Arbitrageur