In 17 days time, Africa’s second largest copper hotspot heads to the polls to cast 5 year governance mandate votes. Zambia is one of African democracies that will elect leadership this year. Asides election fever, one topic that continues to make headlines, starting last week into this week is the aggressive Kwacha rebound, 9.8% (surely not acceleration due to gravity) 7 days straight to levels last seen in October 2020. This has fuelled speculation among corporate players and the retail faculty on when exactly to exit foreign currency risk positions for those hoarding dollars as a safer haven store of value and when to buy for those that missed the dollar purchase train last year. For both however, the latter and the former, behavioural tendency is shaped by uncertainty around sustainability of the rally especially. This is because the recent trajectory is backed more by central bank interventions in a complex economic environment rather than backed by real and robust evconomic activity.

Zambia’s Treasury Secretary – Fredson Yamba. The MinFin issued a press release explaining recent appreciation of the Kwacha and stability seen in the year.

The Zambian treasury on July 23 was more elastic than the central bank in issuing a press release justifying the recent stability in the copper currency and the appreciation as due to central banks market presence selling dollars on the open market supported by foreign currency inflows from mineral royalties that take a cue from all time high red metal prices and those from offshore players that hunt yield in government securities. As though it was not the MinFins mandate, the Bank of Zambia a day later issued a comprehensive Monetary Policy Committee (MPC) note specifying the quantum of dollars sales in the market that has manifested in an FX rally seen in the period.

Bank of Zambia governor – Christopher Mvunga the man at the helm of Zambia’s monetary policy.

It is clear that supply demand fundamentals drive pricing in the currency market and to that effect the communique reveals a sharp decline in absorption of pipe line demand from highs of $481 million to lows of $5 million. This is the pipeline demand and dollar scarcity era that saw fuel supply disruption. The implications of this being dollar scarcity observed earlier in the year is non existent. But to absorb this earlier backlog the supply side saw a boost from higher mineral royalty taxes tapping off all time high red metal prices and better export proceeds in the non traditional export space. However the communique reveals more government business activity as opposed to the private sector bullishness which raises the question of sustainability. It is about a dry point of construction that it is the role of the fiscal side to jump start economic activity by any means as seen in Zambia’s case however for the sustainability of the rally, there will be need for stronger private sector pulse. Current private sector pulse remains subdued as seen by the manufacturing health sector gauge the Markit Economic Purchasing Managers Index – PMI that remains below 50 (readings >50 reflect expansionary while <50 contractionary manufacturing pulse) at 49.3 (June).

Receipt of AstraZeneca’s COVID-19 vaccine at Kenneth Kaunda International Airport – KKIA. With increased SDRs African nations will be empowered to accelerate rollouts to attain herd immunity and get a healthy workforce back to worth to drive growth.

Arguably, the intervention in this case could be to stimulate private sector activity so as to lower the input cost quagmire driving inflationary pressures but on one end the central banks communique suggest more of speculative projections such as on expected mineral royalty tax proceeds and anticipated global bond appetite especially for emerging market paper and the much spoken about special drawing rights (SDR) flow with an already ear-mark of $200 million to $1 billion for vaccine purchases for circa 9 million adults in Zambia. There seems to be a misconception around what the SDR increase will be for exactly but inferring from what the increase was approved for, COVID relief in vaccine finance so that Africa accelerates in rollout program than knocking on multilateral doors for assistance, it will be more prudent to look at that forex supply line as a healthcare buffer than an additionally layer to the $1.4 billion foreign exchange reserves. After all a healthy workforce is more productive as there will be less pandemic induced disruptions and sector dents.

WHAT IS THE CURRENCY REBOUND SIGNALING TO THE MARKET

Zambia’s net import position places substantial demand for foreign exchange and as such depreciation to some extent is a stronger sign of economic activity boom but does necessitate central bank intervention to stabilise prices and manage a run away currency. A rally in this case is a reflection of a stronger supply side outwitting demand in a pandemic induced demand side raising the question of sustainability should the currency continue to hold at these levels. The biggest misunderstanding has been proxying currency appreciation as an indicator for robust economic growth for a nation that is a net importer and in the absence of a solid foreign exchange reserve build up. The cost of intervention if the private sector does not reciprocate through increased activity is depletion of reserves. However the exchange rate appreciation has overnight dented agriculture export growth which has been a resilient driver of growth recovery in these pandemic times. Agriculture was the leading contributor to overall 1Q21 gross domestic product – GDP due to exports supported by a weak currency. Agriculture exports between Jan – May 2021 are at $236 million which is 16.0% above pre- pandemic levels and 50.0% above last year same period. However it can also be said that the rally is more consumer targeted more than consideration for businesses taken into account.

Zambia’s debt repayments have been suspended and as such has defaulted on dollar coupon repayment on its outstanding bonds for maturity in 2022, 2024 and 2026. Rise in metal prices improves the country’s cashflow for debt service which will be key in absorbing obligations at some point. Successful debt restructure is linked to an IMF deal which is anticipated by 1Q22. Zambia will need to prepare a buffer of foreign exchange which it will require to draw from to absorb its dollar denominated outstanding obligations which will have to be paid at some point. For as long as foreign currency debts are not serviced, risk aversion will persist and could cause volatility in the forex market and breed asset sell-off pressure when the inflation quagmire in west phases out for which the US Fed deem it temporal.

US Fed Chair Jerome Powell.

TECHNICAL ANALYSIS OF THE KWACHA AGAINST THE DOLLAR

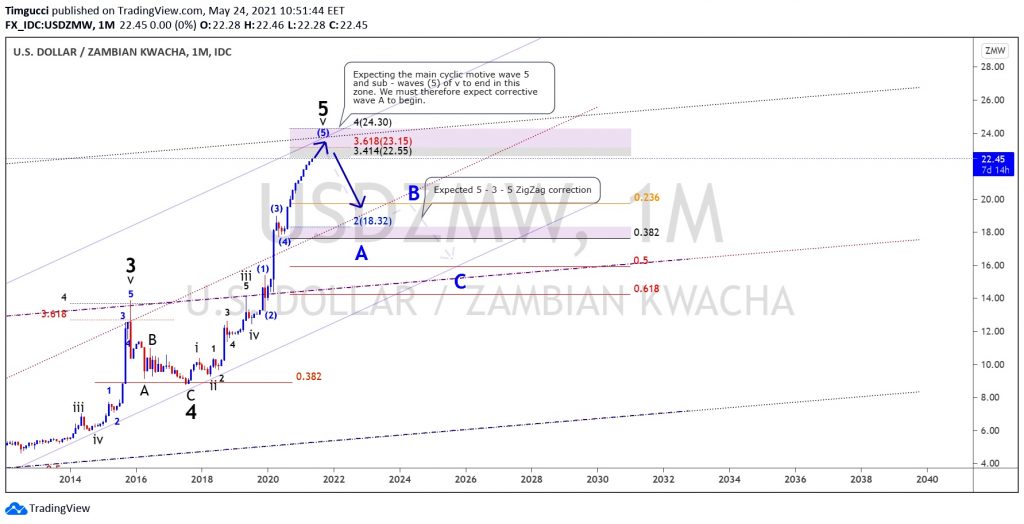

According to our earlier technical analysis in an article entitled Copper bulls just changed Zambia’s currency forecast, a rally expected into 2022 ceteris paribus, the Kwacha was headed towards a rebound in 4Q21 into 1Q22 but this has been accelerated by central bank intervention.

The USDZMW price chart showed two bullish ascending channels in which prices have been trending. Prices made an alternation around the 4th wave in July 2017 and created an extended impulsive wave 5. At the time, the USDZMW was in its final advance of the extended motive wave 5 which was to be expected to end at the vertex of its ascending resistance. The Fibonacci retracement levels around this zone lay around 3.618 to 4.0, representing a resistance zone between 23.15 – 24.30 Zambian Kwacha (ZMW) against the US Dollar (USD). Fifth wave extensions are followed by swift price retracements and their occurrence as in the case of USDZMW gives an advance warning of a dramatic reversal in price and this will lead to appreciation of the Zambian Kwacha. However this has been accelerated by central bank intervention through aggressive selling of dollars on the open market. As such we should expect the 17.9-18.0 levels to be the next settlement points at this rate. Factoring in the overall economic landscape and Zambia’s net import position nonetheless sustainability could only be achieved if the Bank of Zambia continues to sell dollars whose cost could be that of depleting reserves. This kink in the foreign currency trajectory curve could be temporal but the appreciation trajectory will continue but at a slower pace outside of intervention.

Market speculation will nonetheless cloud the Southern African nation in this Kwacha rally period as players hedge their bets on sustainability concerns.

The Kwacha Arbitrageur