Being the first African nation to default in COVID era after skipping a $42.5million coupon payment on a dollar bond maturing 2024 in 4Q20, the continents second largest copper producer Zambia is in the labyrinth of both an economic and a health crisis. Like the rest of the world, the Southern African nation faces rising epidemiological risks in a second COVID infection wave surge which is more stringent and deadlier than the first wave. Health authorities have attributed the exponential spike in cases to super spreader events such as social outings especially during the festive period when citizens slackened in adherence to the five golden rules namely social distancing, hand santization, fully masking up, staying at home and not touching ones face. Jurisdictions such as Britain will not allow travelers that have transited through Zambia in the last 10 days from January 09 to enter due to the high-risk status the copper producer has been tagged due to the rising cases.

SPIKE IN CASE COUNT AS SECOND WAVE HITS ZAMBIA

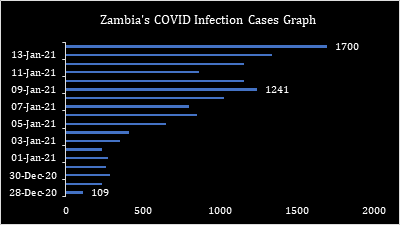

Zambia’s case count has been on an exponential trajectory with the highest daily infection number of 1,700 on January 14, following increased mass testing bringing the cumulative infection rate to 32,800 out of a cumulative tests of 739,188. Mortality stands at 1.56% (514) while recoveries on record are 22,504. Zambia has a population of 17.2million. See infection trajectory to date below as complied with data extracted from the MOH.

RISING INFECTIONS FUELING DEMAND FOR RAPID TEST KITS

Like the rest of the world, pharmaceuticals remain an overnight emerging sector supported by increased demand for medical supplies. One key commodity whose demand has trebled in this disease pandemic era is oxygen to service intensive care units (ICU) for patients with breathing problems. Other medical supplies that have seen a surge in demand include azythromycin (the antibiotic recommended), aspirin, eucalyptus oils, paracetamol and sanitizers that are key in treating and curbing COVID19. The recent spike in infections have precipitated bottlenecks in the faculty of test-kits that are by the day becoming scarce. Shortages of test-kits at centre have persisted over the last two weeks as cases spike.

Supply bottlenecks remain a function of cost versus demand escalation on the back of not only rising cases but anxiety among citizenry keen to know their status in these difficult times. More and more Zambians are eager to know their respective status, but this nonetheless has revealed a rising preference for rapid (instant) test kits that provide results within the minute compared to PCI test kits which should provide results within 24 hours. However the PCI test kits now takes as long as 5-days due to overwhelming status of laboratories in Zambia. Medical practitioners and front-line health staff have been allocated rapid test kits arguably because of the nature of their jobs that exposes them to contraction through a widened threat-landscape. This has created illicit avenues for those that seek to exploit desperate citizens through charging exorbitantly for home testing methodologies. The supply-demand mismatch has created a parallel market for test kits. These are blips of economic hardship for the copper producer.

RISING CASES IMPLICATIONS ON THE ECONOMY

Business disruption remains the order of the day with infections leading to operational resilience blips that affect service delivery by key business players across the sectors. In the first wave it was vivid that lockdowns impacted the business ecosystem leading to job losses, slow down in economic activity in key sectors such as airline, real estate, hotel and tourism, transport to mention but a few and a significant dent on the education calendars. With already frail fundamentals pre-COVID, the disease has had the effect of amplifying economic woes to hike the cost of living for the Zambians.

Inflation is double digit having rallied to a 52-month high at 19.2% while the copper currency, Kwacha, weakened 43% to trade north of 21 for a unit of dollar. There has never been a time in the hostly of the nation that disease pandemic has gobbled so much in resources for public health care purposes at the expense of other growth driving sectors of the economy. The year 2020 was forecast to receding 4.2% (IMF) while the surge in infection remains threatening Zambia’s 2021 macroeconomic target of 1.8% rebound projected earlier by the Ministry of Finance. Zambia will have to deal with a cocktail of sovereign and epidemiological risks in 2021.

Being one of the African nations heading to the polls, political risk factors will price into the market as expected.

The Kwacha Arbitrageur