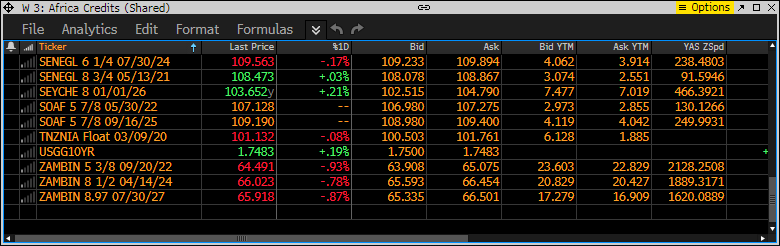

With a deepening energy crisis as drought effects thicken, Zambia’s odd of a lower credit assessment with the international credit rating agencies is narrowing. Currently rated at CCC+/CCC/Caa2 by S&P/Moody’s/Fitch, the copper producer grapples with waning sentiment as evidenced by a widening in its credit default spreads on its dollar bonds maturing 2022, 2024 and 2027 respectively. The running Eurobonds have blown out to between 1,650-2,150bps above 10 year US treasuries currency paying 1.775%. Zambia’s 2022s are paying 22.1% in bids while the longer dated 2027s are paying 18.6% in bid, the worst performing frontier market assets.

Currency risks remains high with the Kwacha trading at all time lows of 14.12 for a unit of dollar with some traders seeing the vulnerabilities widen to 14.55 levels as early as next week. The central bank sterilized the market by hiking not only to overnight rate to commercial banks by 1,000bps to 28% on 14 November to reign in on inflation but also adjusted the benchmark interest rate 125bps to 11.5% on 20 November.

Cost push inflationary effects could widen the already double digit consumer price index of 10.7%. Energy risks to inflation are elevated as load management widens thereby impacting the private sector cost environment. Business pulse has been in the woods for 14 months and is forecast to contract further as measured by purchasing managers index. This aligns to the growth expectations of below 2% as projected by the Washington based lender IMF Article IV mission team in their last visit.

The IMF stated that debt and drought effects were key drivers of the deteriorating fiscal position that required that Zambia steps up its fiscal consolidation efforts to restore the red metal producer on a path to recovery. A sliding currency translates to 76% of debt to GDP at current exchange rate increasing the cost of debt service.

Drought effects have manifested in low crop yield and rising food security risks which have in part been hedged by maize buffer stocks held by the reserve agency.

Given the actualizing risks to growth, Zambia’s credit quality could suffer a further downward adjustment by the international rating agencies.

The Kwacha Arbitrageur

1 Comment

Pingback: S&P downgrades Zambia's sovereign rating to 'CCC' from 'CCC+' on rising debt service risks | The Business Telegraph