Economic fundamentals point to a fading dovish stance on interest rates. May meeting could be the first rate tightening cycle in 41 months

Barely a month away today, Zambia’s central bank will commence 2 day deliberations for the second rate decision of 2019. With two underwater outcomes from the 25 and 26 April debt sales, with K2.6 billion on offer, filling only 25% (K658 million worth of securities). The next critical event on the money markets calendar for the Bank of Zambia – BOZ save the usual fortnight treasury bill sales, is the rate decision meeting.

The BOZ has maintained a dovish stance for 15 months since February 2018 when it last eased monetary policy that lowered the benchmark rate to 9.75% (from highs of 15.5%) as the statutory reserve ratio relaxed to 5% (from 18.5%). At this point the BOZ eased monetary policy after penalizing the private sector since December 2015 when the prime rate was hiked 300 basis points to 15.5%, a move made to curb a currency slide that saw the Kwacha weaken to K14.2 levels on speculative and other fundamental pressures during an energy poverty era. Growth crimpled significantly as the copper producer grappled with energy deficits of circa 500MW which weighed the macros.

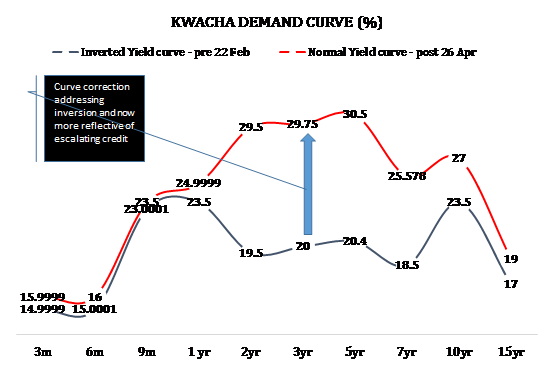

Fiscal risks price – in – from inverted to normal curve

Zambia is currently dealing with rising public debt, liquidity constraints manifesting in unfilled treasury bill and bond auctions in an interest rate rising environment. Yields on government debt are elevated with 2,3 and 5 year paying between 29.5% and 30.5% as credit risk prices into the money market. The two fixed income sales of the year 2019 have seen curve correction upwards to levels reflective of the country’s sovereign risk profile (Moody’s/Fitch/S&P – Caa1 (stable)/B-(negative outlook). In Februarys bond auction, the Kwacha yield curve corrected the risk inversion of higher yields in the shorter end – treasury bill – which ideally signal recessionary risks. This was a similar alarm bell that the US Federal reserve has sleepless nights about a few weeks ago but for the GDP data that printed higher at 3.2% for Q1 allaying recessionary fears. This has however since corrected with the 26 April debt sale widening yields to between 29.5%-30.5%. Suffice to say the term structure of Kwacha interest rates is now fairly a normal upward trajectory with all kinks save in the longer end on existent.

Funding deficit pressures evidenced by debt sale subscription haircuts

The central bank as a borrowing agent of the government have to date only satisfied 59% of the funding appetite requirement of the state. Of the 11 treasury auctions only K7.02billion has been raised leaving a deficit of K4.83billion ($380 million) in unabsorbed needs. To that effect, the state is pressed with funding needs to meet public sector wage bill obligations which is now forcing the central bank to accept cheeky bids in the 30s (thirty percentage points) as they have no other funding options. As such, credit risks have deteriorated significantly with rating agencies such as Moody’s hinting possible assessment lowering of Zambia’s local and foreign currency ratings last updated in July 2018 at Caa1 with stable outlook. Moody’s were in the country in February for a rating assessment which is currently being finalized.

Upside risks to growth – inflationary pressure

Most central banks globally have adopted forward looking monetary policy stances taking into account risks to growth for respective economies in light of the global ecosystem. Zambia’s risks to growth include rising crude prices with international benchmarks such as ICE Brent at $74/bbl supported by OPEC led supply cuts and effects of Iranian sanctions. These oil price bulls could spell cost push inflationary pressures for the copper through elevated manufacturing cost curves that could in turn slow business pulse as measured by Purchasing Managers Index (PMI). Zambia’s headline PMI is in the red (below 50) at 48.1 (March) on account of weak aggregate demand and uncertainty and against the odds the easing in diesel prices by 8.33% did not provide any support to the headline reading for March.

Inflationary pressure persists with the CPI gravitating on the upper bound of the 8% bracket of the BOZ targeted range of 6-8%. Risks to inflation are high stemming from potential proposed retail energy rate hikes, low dam levels exacerbating energy supply risks and food security concerns. The Ministry of Agriculture announced a ban on maize exports as the state takes stock of grain inventory to hedge against food security risks. With fading dam levels at the Kariba currently at 35% (as at 08 April) comparing with 61% same time a year ago ZESCO could have rationing under its sleeves off course not as intense as the 2015/2018 era on the back of other supplementary independent power producers. If this materializes mining productivity could take the brunt as the sector consumes 57% of the grid to the extent that rationing could impact the flow of mineral royalty taxes which are the fall back conduit to shoring up foreign exchange reserves. Inflation direction, whether cost push or demand pull, could shape the direction of monetary policy. All these upside risks point to the end of the BOZ dovish stance on interest rates.

Zambia’s growth forecast was lowered to 3.3% from 3.4% on account of rising expenditure in infrastructure spend. Balance sheet vulnerabilities persist with external debt rising to $10.05 billion as domestic arrears widen to K15.5 billion exerting pressure on debt service. A delayed IMF deal closure doesn’t make it any better for investment flows and pricing of dollar debt in the international capital markets.

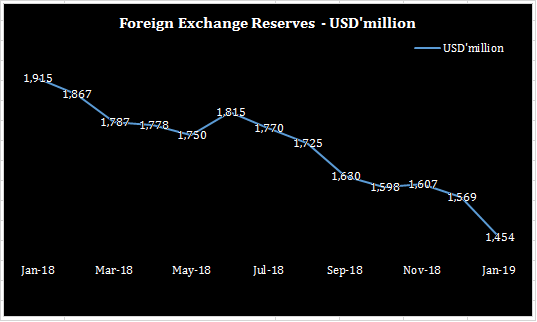

Currency risks and falling reserves

Currency risks are high as the BOZ grapples with adequacy in foreign exchange reserves at less than 1.7 months of import cover at $1.45 billion. The Kwacha has been on the back foot sliding to K12.7 from year start levels of K10.89. Dollar demand from offshore players disinvesting Kwacha asset portfolio’s has increased significantly thereby contributing to asset sell – off pressure. The BOZ has been in the market for dollars shoring reserves which are currently low. Bullish GDP growth out of the United States on 26 April, has made the dollar index (DXY) stronger as measured against a basket of 6 major currencies and hovers around 23 month highs at 98.22.

This has put emerging and frontier market currencies under pressure, the Kwacha inclusive. A strong dollar environment does not make it any easier for riskier asset appetite i.e for base metals in local currency terms. Copper as a bell weather of economic pulse has been resilient between $6,300 – $6,550 a metric ton driven by a stronger Q1 growth in China at 6.4% – higher than analyst estimates and a widening global deficit as advised by the International Copper Study Group – ICSG. Resilient copper pricing is Zambia’s silver lining though the delayed proposed sales tax breeds uncertainity around what the production capacity will be given the effects this will have on the key miners. Budget credibility could also be at risk as the funding cover for the proposed expenditure for 2019 is unclear given that GST implementation was postponed.

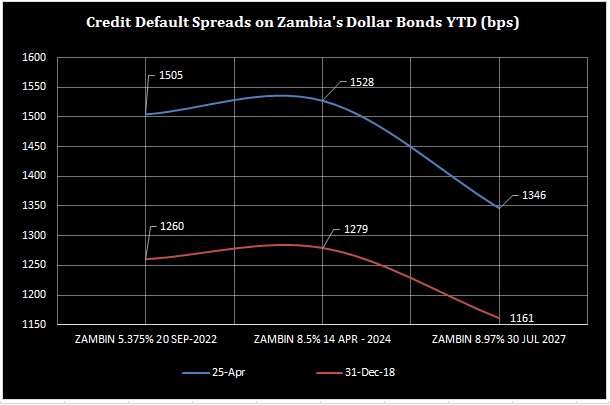

Widening default spreads and NDFs at a premium

Confidence as measured by credit default spreads on outstanding dollar bonds and the Non Deliverable Forward – NDF curve, is waning. Credit spreads on Zambia’s 2022, 2024 and 2027 are priced at 1,505,1,528 and 1,346 basis points above similar tenured US treasuries widening from levels of 1,260, 1,279 and 1,161- bps as at 31 December 2018.

NDFs are still trading at premiums above the current treasury bill curve signaling further latitude for short term Kwacha yields to balloon further. A rate rising environment has the detrimental effect of shaving asset valuation.

Could May 19 be first rate hike since Dec 2015?

All odds point to a rate tightening cycle to stem a currency slide and manage fiscal risks to the economy. However if this stance prevails it will surely be counter intuitive to the growth momentum of the economy which might be a Dejavus of the penalization of the private sector as was observed post December 2015. At some point inflation and the currency have to go if the fiscals are not reigned in through a halt on expenditure. Suffice to say monetary policy has bottomed entailing zero latitude to create further stimulus for growth. There is a very high likelihood that the BOZ may keep its stance dovish next May but this will just balloon pressure for a bigger jump in rates as an when it happens. It would be wiser to graduate the increase for markets to absorb.