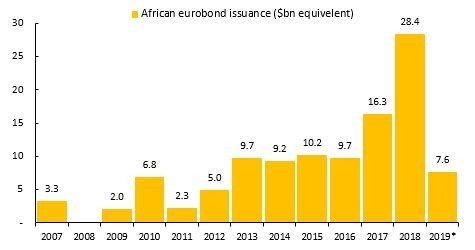

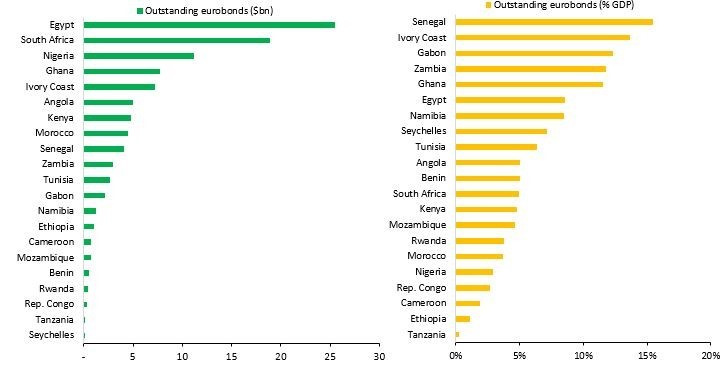

We have shifted from a narrative of debut eurobonds, to one of repeat African eurobond issuance. With Ghana’s issuance on March 26th the asset class reached $102 billion (outstanding sovereign eurobonds in euro and dollar). With record sovereign issuance of $28.4 billion in 2018, and $7.6 billion so far this year (from Egypt, Ghana and Benin in quarter one) the asset class has grown rapidly.

Egypt and Ghana both included 30-year paper in their quarter one issuance. This continues a trend started in November 2017 for longer-dated paper. With increased issuance over the past two years, Egypt has surpassed South Africa as the continent’s largest issuer. Nigeria has also accelerated its issuance and joins them as a heavy-weight issuer. With Benin’s debut eurobond issue this year, there are currently 21 countries who have outstanding sovereign eurobonds.

Countries looking like they are preparing to issue in 2019 include: South Africa, Kenya, Angola, Egypt (for a second time) and Nigeria. But total 2019 issuance looks likely to be smaller than in 2018.

First quarter 2019 performance

Africa eurobonds performed very well in January, well in February, and performance in March was mixed. After a very tough 2018, the first few months of 2019 has been much better for African eurobonds (see a January post on what to expect this year here). A shift to a dovish stance by US Federal Reserve helped improve sentiment towards emerging and frontier markets. Throughout quarter one money flowed into bond funds investing in African eurobonds. This has increased their prices. Yields and the cost of borrowing for African issuers have declined relative to the second-half of 2018.

- All African countries eurobonds rallied in January and top performers were Zambia, Kenya, Angola, Gabon, Cameroon and Ethiopia (mostly because these credits sold-off heavily in 2018).

- In February the gains were less pronounced but continued for all countries except Mozambique (where legal proceeding undermined confidence in a quick restructuring of the eurobonds). Egypt, Kenya and Nigeria performed best. Republic of Congo and Zambia’s recovery began to lag that of peers.

- March performance was mixed. Tanzania, Morocco and Ghana continued to tighten the most (but average yields dropped only by a little). The weakest March performance was from Cameroon, Mozambique, Tunisia and Zambia. Zambia’s volatile eurobonds sold-off heavily and their 2019 gains were reversed in March.

First quarter snippets

- Moody’s, a credit rating agency, improved the outlook on their Mozambique credit rating (Caa3) from negative to stable. Moody’s also rated Mali who are yet to issue eurobonds.

- Fitch gave Benin a new rating (B), upgraded Egypt’s credit rating (from B to B+), upgraded Republic of Congo (from CC to CCC) and reduced the outlook on their Namibia rating (BB+) from stable to negative.

- Standard & Poor reduced the outlook on their Angola rating (B-) from stable to negative.

Gregory Smith is a Fixed Income Director at Renaissance Capital.