Johannesburg Stock Exchange listed Gemfields incurred a FY18 net loss of USD$60.4 million, compared with USD$45.1 million profit a year earlier, this was contained in a trading statement published on Friday 21 March. According to Gemfields group, the loss was attributed to impairment charges and fair value downward adjustments that eroded the miners EBITDA.

Excluding the impairment charges and fair value losses, as well as dividends received and costs related to a settlement with law firm Leigh Day, the group’s profit for the year was USD$18 million, the trading statement said.

Gemfields on 25 March reported a headline loss a share of USD$0.03 for 2018, compared with a headline loss a share of USD$0.06 a year earlier. This excludes the impairment charges recognised for 2018. It further reported a loss a share of USD$0.05 for 2018, compared with earnings a share of USD$0.04 in 2017.

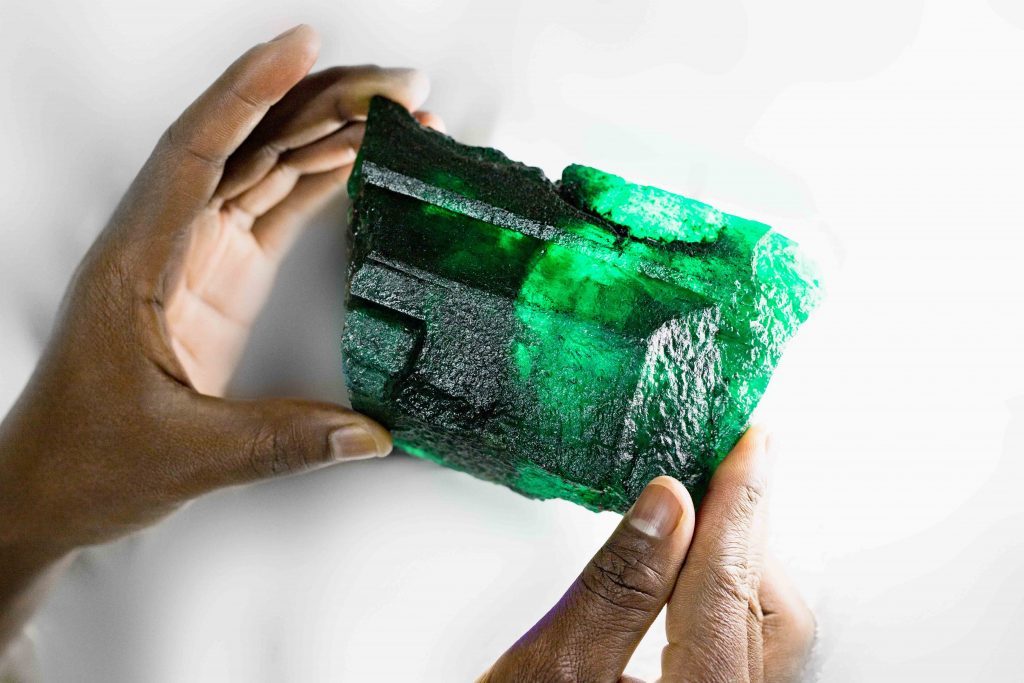

Gemfields generated revenues of USD$206.1 million, following 4 high-quality and commercial quality rough emerald and beryl auctions and two HQ and CQ rough ruby and corundum auctions.

The two ruby auctions generated USD$127.1 million, while the four emerald auctions earned Gemfields USD$60.3 million for the year.

The HQ and CQ emerald auctions realised higher average prices per carat at USD$65.55 and USD$3.54, respectively, demonstrating some green shoots of recovery in the Indian market following the recent downturn and property market slump.

The HQ auction held in Singapore in November 2018 realised the second-highest price per carat in Kagem’ s history of $68.03.

Gemfields is the operator and 75% owner of both the Kagem emerald mine, in Zambia, and the Montepuez ruby mine (MRM), in Mozambique.

MRM achieved record revenues during the year, with the mixed-quality auction in June 2018 having realised USD$71.8 million at an average price of USD$122.03/ct, and the November 2018 auction realising USD$55.3 million at an average price of USD$84.32/ct, as the ruby market continued to show signs of strength and stable demand.

Gemfields’ wholly-owned Faberge subsidiary generated revenues of USD$13.4 million, underpinned by retail sales of USD$4.2 million, wholesale sales of USD$6.8 million and USD2.4 million from other channels.

Total operating costs at Faberge are at their lowest level of USD$9.9 million, reflecting the continued benefit of the cost optimisation and efficiencies implemented, which saw reduced labour and marketing and advertising spend, as well as the benefit of a weaker pound.

With record revenues achieved at two HQ auctions at Kagem, coupled with fairly flat costs reflecting the group’s ongoing cost optimisation strategy, EBITDA was USD$58.9 million.